Office Address

Ist Floor, 38 N, Shree Balaji Tower Hisar

Phone Number

+91 98965-80000

Ist Floor, 38 N, Shree Balaji Tower Hisar

+91 98965-80000

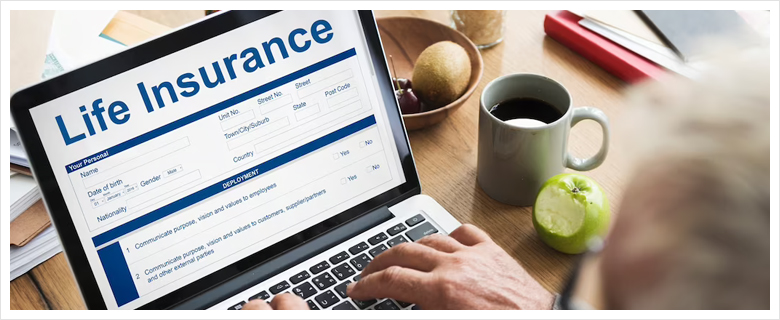

We always want the best for our family and life is full of uncertainties. There is an 'IF' in 'LIFE'. Hence planning for the contingencies and taking concrete steps to secure our family's future is of utmost importance. For there is no way to ascertain as to when one might lose the ability to provide for them due to disability or the sudden loss of life.

Term Plans

Endowment Plans

ULIP Plans

Pension Plans

Business Protection Plans

Employee Benefit Plans

Life insurance is a guarantee that your family will receive financial support, even in your absence. Put simply, life insurance provides your family with a sum of money should something happen to you. It thus permanently protects your family from financial crises.

Today, there is no shortage of investment options for a person to choose from. Modern day investments include gold, property, fixed income instruments, mutual funds and of course, life insurance. Given the plethora of choices, it becomes imperative to make the right choice when investing your hard-earned money. Life insurance is a unique investment that helps you to meet your dual needs - saving for life's important goals and protecting your assets. Let us look at these unique benefits of life insurance in detail.

People these days are prone to many diseases as a result of which the longevity of life is also reduced. Thus it gets important to take an appropriate risk cover and give your family a financially secure future.

Insurance policy also helps to cover up one's loans and liabilities. The house one buys for our shelter, we would never want to let it go. Thus an insurance policy can help one to cover the loan liabilities.

Calculating how much life insurance you need is one of the most important financial decisions you will ever make. It should never be an isolated decision depending only on how much of a premium you can afford.

This is one of the basic methods of insurance calculation and is based on your current annual income.

Insurance needs = annual income X number of years left for retirement.

Let's say your annual income is Rs 5,00,000. And you are 45 years old with 15 more years for retirement.

In this case your insurance cover equals Rs. 5,00,000 X 15 = Rs 75,00,000.

Another way in which income replacement works is to multiply the annual income by 10 (also known as Income Replacement Multiplier).

This method of calculating life insurance is based on contribution that one makes and would have made to her/his family in case of sudden demise. So HLV is defined as the present value of all future income that you could expect to earn for your family's benefit. It also includes other value you expect to contribute, less personal expenses, life insurance premiums and taxes through your planned retirement date.

So if your age is 35 yrs old, your annual income is 20 lacs and your personal expenses are 5 lac. Assuming inflation rate of 5% p.a. and that you plan to work till 60 yrs, your HLV will be ` 2,21,97,963.

In this method, you can assess your needs -- and the needs of your loved ones -- and make a calculated assessment. The most critical factors are the number of dependents you have and their needs. Other major factors to consider are:

Loans Payoff

Kind of lifestyle you want to provide to your family

Provision for non-working spouse who would no longer get an income

Child's Education

Child's Marriage

Providing for financially dependent parents

Special needs

Dreams and aspirations such as contributing to charitable causes

It shows the premium amounts that an individual at different ages would pay for a risk cover of Rs. 1 Crore for 20 years.

Age

25

30

35

40

45

50

Annual Premium

9700

11050

14750

22025

34375

56625

There is a difference in the premium amount if you take insurance at later ages. This is because the probability of diseases is larger at high ages and mortality is high.

Savings and investments go hand in hand. In fact small amount of money saved magically compounds into a good lump sum amount in future which can be utilized to fulfill one's financial goals and thus results in wealth creation for future. The earlier one starts to plan for wealth creation, the earlier and conveniently the goals of life can be met.

Savings and investments result in wealth creation for an individual. He can use his savings or the lump sum amount that he has created for purchasing any asset he wants and can fulfill his cherished dream.

Insurance inculcates the habit of regular and disciplined savings, which is the key to successful long term financial planning. Pay your premiums regularly and enjoy the uninterrupted benefits of wealth insurance.

Apart from protection and savings, wealth insurance plans also offer tax benefits as per prevailing tax laws.

For more information, please do contact us.