THE BALAJI EDGE

The client needs strong support with regard to claims settlement as

- Solvency Margins of Insurance Companies are under pressure.

- Ambiguity exists in interpreting existing policy terms

- Changes Occur in Policy wordings & Clauses

- Business needs keep on evolving

- Claims under management & with claims paid

- SBIB dedicated claims handling team with 600+ annually

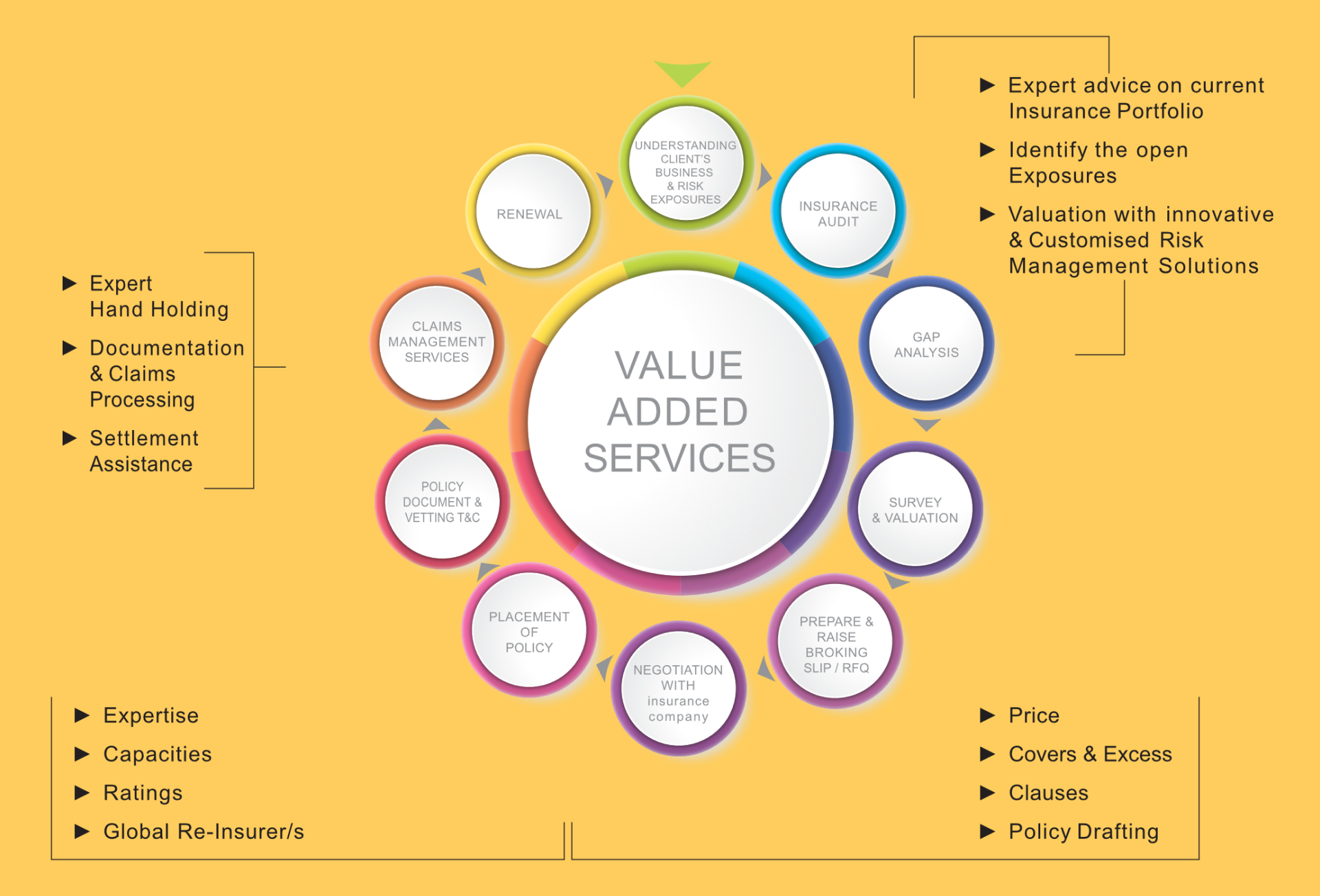

OUR BUSINESS PROCESS

INSURANCE AUDIT

- Expert advice on current Insurance Portfolio.

- Identify the open Exposures.

- Valuation with innovative & Customised Risk Management Solutions.

NEGOTIATION SLECTION OF U/W PLACEMENT OF BUSINESS

- Expertise

- Capacities

- Ratings

- Global Re-Insurer/s

- Price

- Covers & Excess

- Clauses

- Policy Drafting

CLAIMS MANAGEMENT SERVICES

- Expert Hand holding

- Documentation & Claims Processing

- Settlement Assistance

RISK MANAGEMENT SERVICES

⠄Common

⠄Selective

⠄Very Selective

- Loss Minimisation Exercise.

- Thermography.

- Property Valuation.

- Energy Audit/Safety Audit.

- Structural Stability Test.

- Industrial Hygiene Study for Operators-Oxygen Level, Noise, Luminosity etc.

- NAT-CAT Exposure Analysis.

- Emergency preparedness audit

- HAZOP/FMEA/QRA

- Fire Protection System Review (As per international standards like NFPA,FM global etc.)

- Drones Survey

- Portfolio Audit/Benchmarking

- Cyber Exposure Assessment

- Remote monitoring Services

CUSTOMER

SATISFACTION INDEX

To Improve Service experience by understanding Client feedback for every service touchpoint Our Client Satisfaction Index Survey helps us know what our clients say about our services!

Types of Surveys

- Client Review Meeting Survey

- Client Feedback Survey

CSI:

We don’t just hear,

we listen to you

MAJOR CLAIMS HANDLED

| Industry | Type of Policy | Amount of Claim | Cause of Loss |

|---|---|---|---|

| Cotton Industry | Standard Fire & Special Peril Policy | 1.8 Crores | Fire in Plant |

| Cotton Ginning Mill | Standard Fire & Special Peril Policy | 2.0 Crores | STFI Loss In Plant & Stocks |

| Engineering Workshop | Standard Fire & Special Peril Policy | 1.0 Crores | Fire in Plant & Machinery |

| Logistic Company | Vehicle Insurance | 0.6 Crores | Accident of the their Puller |

| Logistic Company | Marine in transit | 0.25 Crores | Accident of their vehicle |

| Logistic Company | Fidelity Guaranteed | 1.25 Crores | Employee Fouad |

| Engineering Workshop | Standard Fire & Special Peril Policy | 1.0 Crores | Fire in Plant & Machinery |

| Storage & Godown | Standard Fire & Special Peril Policy | 13 Crores | Fire in Godown |

DIFFERENCE BETWEEN INSURANCE AGENT & INSURANCE BROKER?

INSURANCE AGENT

Represents insurance company

Appointed by an insurance company

He can work with one insurance company

Recommendation is biased towards insurance company, which he is representing

Most of the time agent has only one company products knowledge

They can't provide the best products as they can't navigate with the multiple companies

Customer have to do ground work if he is dealing with an agent

INSURANCE BROKER

Broker represents client

Appointed by insured / client

Can work with multiple insurance companies

Recommendation is in favour of insured / client

Broker has knowledge of all available products in the market of all Insurance companies

Broker provides minimum 3 quotes with comparitive analysis at best price with best terms available in the market

Broker does all type of ground work for his clients